How an index account works

How an index account works

Indexed universal life insurance

provides two main advantages:

death benefit protection and an index account that protects you from losses through a zero percent floor, subject to a cap and participation rate.

Insurance products are issued by Midland National® Life Insurance Company

Rules of the game

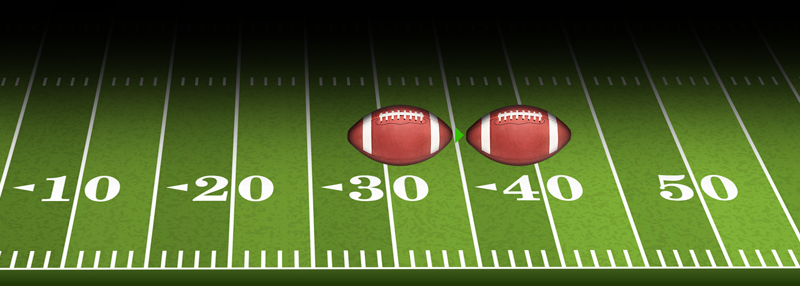

If the index account were a game of football and the football team an index selection in a life insurance policy, here’s a breakdown of how the index account works in simple terms.

It's always first down.

You won't lose yards, (the floor).

Up to a 10 yard gain per play, (the cap).

Midland National changes the rules!

Watch the play‑by‑play below.

The play‑by‑play

Take a look at what happens with these "new rules" in the play‑by‑play below!

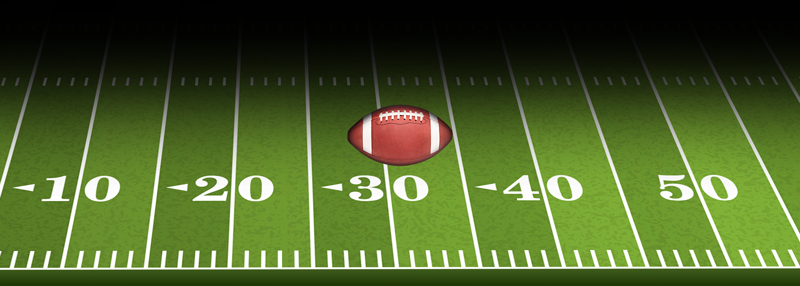

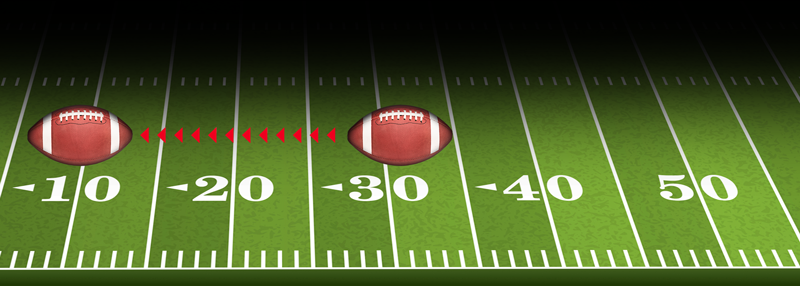

22-YARD LOSS

19-YARD LOSS

Your quarterback is sacked at the 13‑yard line for a 19‑yard loss. But we've changed the rules so that you won't lose yards.

The play‑by‑play

Take a look at what happens with these "new rules" in the play‑by‑play below!

NO LOSS, NO GAIN

NO LOSS, NO GAIN

Even though your quarterback is sacked at the 13-yard line for a 19‑yard loss, the ball is spotted back at the 32‑yard line where the play began, and it's still first down.

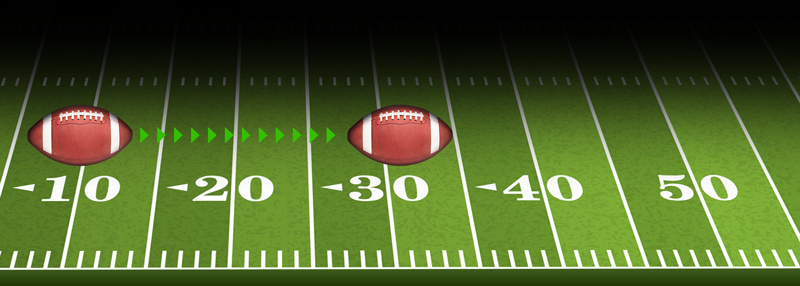

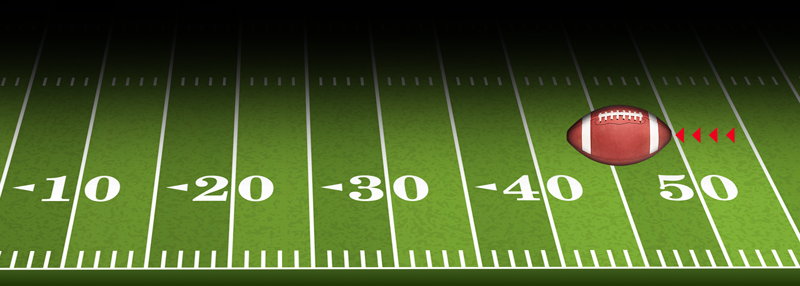

The play‑by‑play

Take a look at what happens with these "new rules" in the play‑by‑play below!

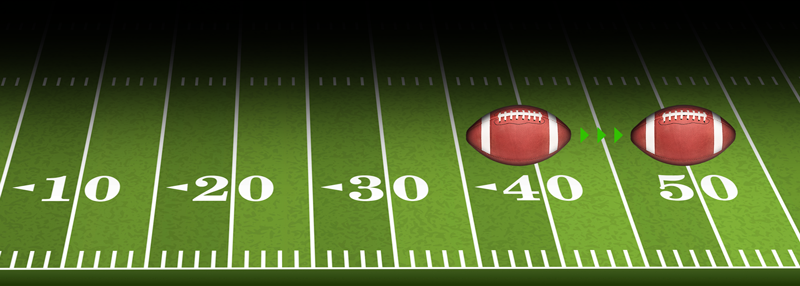

8-YARD GAIN

7-YARD GAIN

The play‑by‑play

Take a look at what happens with these "new rules" in the play‑by‑play below!

9-YARD GAIN

10‑YARD GAIN

Even though you made a 12‑yard play, the 10‑yard maximum kicks in so your team has to "give back" 8 of the yards. The net result is a gain of 10‑yards, and the ball is spotted squarely on the 50‑yard line.

Click on the "NEXT" button or the numbers here to view play‑by‑play!

Game summary

Under normal rules, the team would have gained a total of 16 yards (gains of 9, 8, and 18 with a loss of 19 yards) and the ball would have been spotted at the 39‑yard line.

However, with the "new rules," the team gained 27 yards and the ball is spotted squarely at the 50, which is an extra 11 yards downfield!

Scroll to game summary

What does this mean for you?

Imagine if the football team was an Index selection in an indexed universal life insurance policy. The maximum 10 yards represents the cap rate, and the fact you never lose yards represents the floor with no downside risk. Each play is a year and the yardage gains are locked in interest crediting!

Talk to your Midland National financial professional for details on how you can put an indexed universal life insurance policy to work for you.

© Midland National {{CurrentYear}}

MARKETING MATERIALS MAY NOT BE APPROVED IN ALL STATES

Hypothetical examples are only meant to illustrate how this feature functions.

Indexed universal life insurance products are not an investment in the "market" or in the applicable index and are subject to all policy fees and charges normally associated with most universal life insurance.

The term financial professional is not intended to imply engagement in an advisory business in which compensation is not related to sales. Financial professionals that are insurance licensed will be paid a commission on the sale of an insurance product.

Life insurance policies have terms under which the policy may be continued in force or discontinued. Current cost of insurance rates and interest rates are not guaranteed. Therefore, the planned periodic premium may not be sufficient to carry the contract to maturity. The Index Accounts are subject to caps and participation rates. In no case will the interest credited be less than 0 percent. Please refer to the customized illustration provided by your agent for additional detail. The policy’s death benefit is paid upon the death of the insured. The policy does not continue to accumulate cash value and excess interest after the insured’s death. For costs and complete details, call or write Midland National Life Insurance Company, Administrative Office, West Des Moines, IA.

Sammons Financial® is the marketing name for Sammons® Financial Group, Inc.’s member companies, including Midland National® Life Insurance Company. Annuities and life insurance are issued by, and product guarantees are solely the responsibility of, Midland National Life Insurance Company.

254MLG

1-26